Why Women Should Love Stocks

Fearless Girl-Wall Street, NY

The other day, I was rummaging through my files and ran across copies of stock certificates my grandparents bought in the 1930s. As I reflected on these certificates, it struck me that these stocks supported three generations of women in my family.

My grandparents purchased shares in AT&T, Standard Oil, General Motors, and Pet Incorporated. When my grandfather passed away, my grandmother was in her fifties and didn't work, but those stocks provided her enough income to live comfortably. When she passed in 1974 my mother inherited the stocks.

My grandparents were not wealthy, yet they believed in the capitalist engine of blue-chip stocks. Instead of trading the stocks, they held on for the long term. As a result, my mother had a nest egg she could call her own that helped pay for family vacations, my college tuition, and her dream retirement home in Santa Barbara. My parents have since passed, and now I benefit from the investment made in those stocks almost 100 years ago.

As a woman, the lesson I learned is that we should love stocks!

Now you may be thinking to yourself, "Why should I love stocks when lately all I hear is how they’ve been falling?" Consider the following obstacles women face:

1. The Wealth-Gap; Women are often more conservative than men with their money. While more men are investing in the stock market, we are putting our money into a savings account. This approach doesn't give our money the same opportunity for growth, thus we are falling behind in wealth creation.

2. The Earnings-Gap; women earn on average 82% of men's wages. We have less money to work with, so we need to make sure each dollar is invested wisely.

3. The 'Depression Mindset.' Many of us have parents or grandparents who grew up during the Depression of 1929, and this shaped their view of safety and risk, which they may have passed to us.

Redefining Safety and Risk

After the Depression, to many people safety meant investing your dollars into an FDIC guaranteed bank account where you were sure to get your money back no matter what happened to the bank, and risk meant the possibility of losing your money in investments.

Usher in the 1970s when our government took the U.S. dollar off the gold standard causing inflation to accelerate. In light of this, we must redefine safety and risk when it comes to our money. Due to inflation, the dollar you own today will not be able to buy the same amount of goods and services in the future. In this context, we should redefine safety as preservation of purchasing power and risk as losing purchasing power. (Murray, The Excellent Investment Advisor)

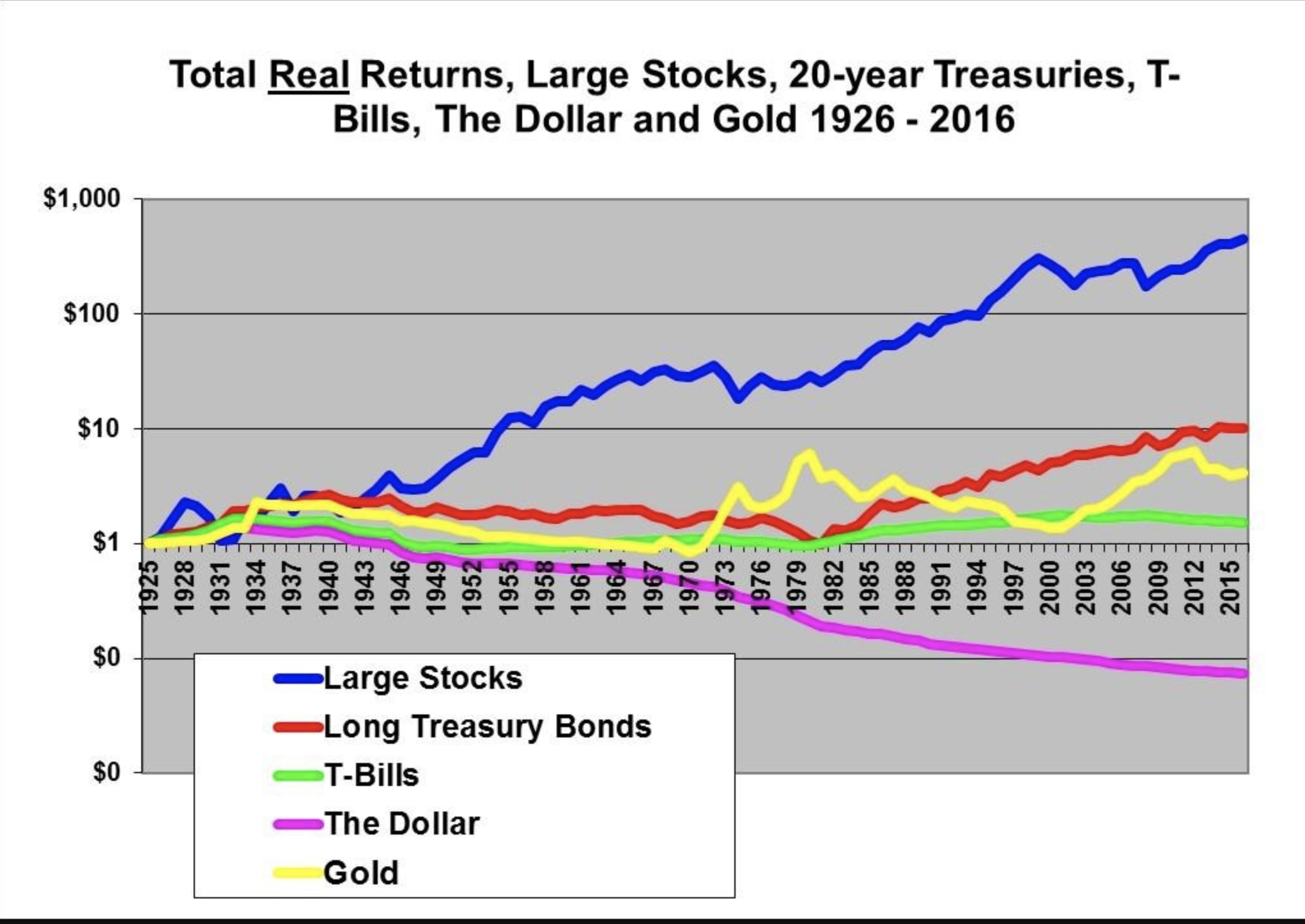

To combat this loss of the dollar’s purchasing power, we need to find an investment vehicle that preserves or increases our purchasing power. From a historical perspective, this vehicle is the stock market. Below is a historical look at the total returns of stocks, t-bills, gold, and the dollar.

As you can see, over the last 90 years, stocks (the blue line) have outperformed bonds, gold, t-bills, and the dollar. Notice the pink line representing the dollar. Since 1970, the dollar has dramatically lost value, meaning purchasing power. Also notice the blue line for stocks trends upward! Indeed, there have been dips and valleys along the way, so we must take a LONG-TERM approach when investing in stocks. That way, you are less concerned with the temporary 30% decline and more concerned with missing out on the 200% advance! (Murray).

A quick primer: A stock represents the ownership of a fraction of a company. Owning stock gives you the right to vote in shareholder meetings, receive dividends (which are the company's profits), and be able to sell your shares to somebody else. Why have stocks historically returned more?

One reason stocks have better returns is the inherent risk of running a business. As a shareholder, you are compensated for this risk in the form of dividends, stock price appreciation or both. Think ‘More Risk, More Reward.’ Building wealth with stocks takes time and investing in quality companies. The risk is real that you can lose money so it is important to do your research and diversify your investments. Fortunately, unlike decades ago when my grandparents were investing, we can now own shares of 1000 of the world's best companies through low-cost index funds or mutual funds.

The Only Way to Get Ahead and Stay Ahead

As women, when we understand the modern definition of safety and risk, we begin to appreciate the only way to get ahead and stay ahead is by investing in good-quality companies. Inflation and taxation are constantly eating away at our purchasing power so by investing in a diversified portfolio of stocks we have the best opportunity to create long-term wealth for ourselves and future generations.

I am a true believer in quality companies and their ability to create long-term wealth for their investors. I owe the ability to start my company, Marathon Wealth Management, to my grandparents' wise investment in America’s Blue-Chip companies.

If you still aren’t convinced you should love stocks, I’ll leave you with a quote from one of the greatest investors of our time,

Warren Buffet

From his 2004 shareholder letter:

“Over the 35 years, American business has delivered terrific results. It should therefore have been easy for investors to earn juicy returns: All they had to do was piggyback Corporate America in a diversified, low-expense way. An index fund that they never touched would have done the job.”

For more information on how to build an investment portfolio, please visit my previous article here.

Opening photo courtesy of Claire Sirich, who herself is a Fearless Girl.